Momentum for a low-carbon economy is building, but much more needs to be done. International partnerships can help catalyse the economic growth and emissions reduction to get us there.

The Global Commission makes 10 key recommendations in which partnerships can help deliver better growth and a better climate.

The world is changing before our eyes. As discussed in Better Growth, Better Climate, new patterns of international production and trade, demographic change and technological advances have dramatically altered the shape of the global economy over the last two decades. “Business as usual” is thus no longer an option. Structural change is inevitable – but that change can be steered to make economies at all levels of development stronger, more equitable, more sustainable and more resilient.

Several emerging trends and developments offer new opportunities to accelerate the transition to low-carbon growth and prosperity. In this section we highlight six: rapid innovation and declining costs of clean energy technologies; the fall in oil prices as an opportunity to advance carbon pricing and fossil fuel subsidy reform; growing international attention to infrastructure investment, particularly in the context of low interest rates; heightened awareness of climate risks in the financial sector; rising interest in low-carbon growth pathways in emerging and developing economies; and an acceleration of the decline in the carbon intensity of the global economy.

This is a time of huge opportunity. In the second half of 2015, world leaders will agree on new Sustainable Development Goals and how to finance them, and negotiate a comprehensive new climate change treaty. Technology is advancing rapidly, redefining what is possible. New economic trends and opportunities, combined with new leadership commitments, have built real momentum for change. This was already evident when the Global Commission published Better Growth, Better Climate last year; it has kept growing since.

A goal once seen as distant – to end extreme poverty, achieve broad-based prosperity and secure a safe climate together – is increasingly within reach. More and more governments, businesses and communities are actively pursuing it. But significant challenges and obstacles still stand in the way.

This report focuses on how international and multi-stakeholder cooperation can accelerate progress and help overcome key barriers. Such cooperation can take many different forms: it includes partnerships between governments, but also among businesses, investors, states and regions, city and local authorities, international organisations, civil society organisations and communities. Over the last few years many such partnerships have emerged. This report identifies some of the most promising ones and suggests ways to scale them up further. It also identifies areas where new initiatives are needed. As such, it provides a menu of options for different actors to contribute to delivering both economic and climate outcomes.

Better Growth, Better Climate showed how countries at different levels of development can achieve stronger economic growth, reduce poverty, advance development goals, and reduce climate risk at the same time. It focused on the three major economic systems where growth and emissions are concentrated – cities, land use and energy – and called for consistent and credible policies around three key drivers of change – resource efficiency, infrastructure and innovation (see Box 1). It showed that the economic and social benefits alone would make many low-carbon policies and approaches worth pursuing. But it also recognised that the challenges that countries face in tackling these issues are deeply shaped by their history and their political and economic circumstances. Low-income countries in particular need robust international support to make progress on these fronts – and some actions are difficult for any country to take on alone.

This is why international cooperation is so crucial. It is a key lever to strengthen and more effectively distribute the flow of new ideas and technical capacity. It can mobilise and scale up finance, particularly to developing economies. It can help overcome concerns about loss of competitiveness, reduce trade barriers and increase the scale of markets. By working together, countries, businesses, cities and others can move faster and achieve greater gains.

Further international and multi-stakeholder cooperation could also significantly enhance and complement the ambition of countries’ commitments under the expected new climate agreement. The pledges made to date (“intended nationally determined contributions”, or INDCs) are important steps forward, but it is now clear that they are unlikely to add up to a level of emissions reduction consistent with keeping global warming under the internationally agreed limit of 2°C. The INDCs are therefore just a starting point; to avoid even more severe impacts on human well-being and economic growth than are already expected, ambition will need to rise steadily over the next 10–15 years. Cooperative action can make that easier and more cost-effective.

Part 1 of this report outlines some of the major emerging developments and trends which are creating new opportunities to achieve stronger growth and climate action together, as well as continuing challenges. It then looks at how stronger international and multi-stakeholder cooperation can advance and accelerate progress and help tip the balance towards low-carbon global growth. It discusses these different forms of cooperation, and places them in the context of the international climate negotiations. Part 2 then explores 10 areas where there are large, immediate opportunities to galvanise such partnerships, summarising in-depth analyses set out in a series of Working Papers which will accompany the report.

The international meetings taking place in the remainder of 2015 – in particular the International Conference on Financing for Development in Addis Ababa in July, the UN Summit to adopt the post-2015 Sustainable Development Goals in New York in September, the G20 Summit in Antalya in November, and the Paris Climate Change Conference (COP21) in December – are critical moments for the international community. The world’s leaders must rise to the challenge. Failure to seize these opportunities would set back the cause of development and poverty reduction for years. But success could unleash a new era of international cooperation for better growth and a better climate. The Commission hopes this report can contribute to that success.

The Global Commission on the Economy and Climate’s 2014 report, Better Growth, Better Climate, is addressed to economic decision-makers across the world, in both the public and private sectors. It examines the large structural and technological changes already occurring in the global economy, and shows that through targeted policies and investments, countries at all levels of development can build stronger economies while substantially reducing climate risk.

A key insight of the report is that many of the policy and institutional reforms needed to tackle climate risk are also crucial for revitalising growth, fostering development and improving well-being. The opportunities for such reforms are increasing, as emerging and developing economies experience rapid urbanisation and structural change, innovation reduces the cost of a low-carbon transition, and the costs of the current economic growth model become more apparent. Many reforms can generate multiple economic, social and environmental benefits: improved economic performance and faster poverty reduction, as well as cleaner air, more liveable and vibrant cities, and greater resilience to climate change.

The report examines three key drivers of change: efficiency of resource use, infrastructure investment, and innovation. All three offer potential for both improving growth and reducing climate risk. Progress will be especially important in three key socio-economic systems that underpin a large share of the world’s economic activity and greenhouse gas (GHG) emissions: cities, land use, and energy. Credible and consistent policies are needed in each, taking into account the unique circumstances, varying capacities and differing needs of countries at different levels of development.

Cities and urban areas are home to half the world’s population, and account for about 80% of global economic output and around 70% of global energy use and energy-related GHG emissions. Nearly all of the world’s population growth in the next two decades will occur in urban areas, primarily in developing countries; by 2050, two-thirds of the global population will be urban. How cities develop is thus critical to the future path of the world economy, development and climate. A large share of urban growth today involves unmanaged sprawl, leading to congestion, rising air pollution, and high economic, social and environmental costs overall. As discussed in Section 2.1, pioneering cities around the world are demonstrating the benefits of a different approach: more compact, connected and coordinated urban forms built around mass transit. Adopting this model not only leads to more attractive and competitive cities, but higher quality of life, sustained resource savings and lower GHG emissions.

Land use is a key development concern, as roughly a quarter of the world’s agricultural land is severely degraded, and forests continue to be cleared for conversion to crops and pasture, and for timber and mining. Key ecosystem services are being compromised, and the natural resource base is becoming less productive. Yet by 2050, the world’s farms will need to produce 70% more calories than in 2006, due to population growth, rising incomes and changing diets. There is considerable scope to increase agricultural productivity and resilience through new methods of crop and livestock management and the restoration of degraded land, and at the same time to reduce the estimated 25% of food that is wasted globally. Better Growth, Better Climate recommends international cooperation to restore 500 million hectares of degraded forests and agricultural land through scaled-up investment and adoption of landscape-level approaches. It also recommends a scale-up of programmes to protect and restore forests, including reaching at least a US$5 billion investment in REDD+ financing per year. Section 2.2 highlights recent initiatives that can help to deliver this.

Energy use has grown by more than 50% since 1990. Energy services will need to keep rising rapidly to support continued development and bring modern energy access to the 1.3 billion people who lack access to electricity and the 2.7 billion who lack modern cooking facilities, mostly in sub-Saharan Africa and South Asia. Energy production and use already account for two-thirds of global GHG emissions, so how this new demand is met is a crucial determinant of climate risk. Better Growth, Better Climate stresses the need to sharply boost energy efficiency, encouraging governments to treat it as the “first fuel” – a topic discussed further in Section 2.4. It also urges an expansion of low-carbon energy production, particularly renewables, noting their falling costs and the benefits to energy security, air quality and public health. And it calls for an end to new unabated fossil fuel power: in developed countries immediately, and in emerging economies by 2025, while acknowledging the specific needs of lower-income countries. Energy markets and financing methods also need to be adapted to accommodate renewables at scale; this is discussed in Section 2.3.

Cutting across and shaping these three socio-economic systems are three major drivers of change:

Resource efficiency is essential for achieving both better growth and emissions reduction. There are numerous opportunities to boost efficiency in the use of energy, water, land, capital and other crucial resources through reforms to tackle market failures and poor policies. Better Growth, Better Climate recommends that governments introduce strong, predictable and rising carbon prices as part of fiscal reform strategies, prioritising the use of the revenues to offset impacts on low-income households or to finance reductions in other, distortionary taxes. Effective policies will need to be tailored to each country’s circumstances. As discussed in Section 2.5, there has been considerable momentum towards both carbon pricing and fossil fuel subsidy reform in the last two years. In rural areas water, fertiliser and power subsidy reforms are likewise needed to encourage more efficient and sustainable agricultural practices.

Infrastructure investment – in transport networks, power plants and transmission systems, buildings, water and telecommunication systems – is a crucial driver of development, providing critical services and raising the overall productivity of the economy. The nature of infrastructure investment will also determine to a great extent whether economies can shift to a low-carbon path or are locked into high levels of fossil fuel use and inefficient, sprawling cities. The global economy will require about US$90 trillion in infrastructure investments by 2030 across cities, land use and energy systems, especially in developing countries. A low-carbon transition will require a shift in the allocation of this investment, with perhaps a 5% increase in upfront capital needs – about US$270 billion per year. These higher capital costs could potentially be fully offset by lower operating costs, such as from reduced expenditure on fuel. Section 2.6 examines how infrastructure planning can be made both more resilient to climate impacts and compatible with climate mitigation goals.

Innovation is central to economic growth and productivity. Innovation, and the rapid diffusion of clean technologies between countries, is also essential to achieve low-carbon development models, making it possible to continue economic growth in a world of finite resources. Advances in materials science, digitisation, the circular economy and business models are now reshaping industrial production, and creating opportunities for developing countries to “leapfrog” over less efficient, more polluting stages of development. Better Growth, Better Climate argues that public support for energy research and development (R&D) should be at least tripled in major economies by the mid-2020s, to well over US$100 billion per year. It also encourages the use of pricing mechanisms, regulatory standards and public procurement to create market “pull” for low-carbon technologies. Section 2.7 highlights key areas where international partnerships to share costs and knowledge could greatly enhance national efforts, particularly to support growth and emissions reduction in emerging and developing countries.

By pursuing these approaches, Better Growth, Better Climate argues that economic growth, development and climate outcomes can be achieved at the same time: countries need not choose between them. The multiple benefits of climate action include reductions in the health impacts of air pollution, in traffic congestion and accidents; lower risk of locking-in stranded assets; less vulnerability to volatile fossil fuel prices and potential fuel supply disruptions; enhanced productivity of agricultural and forested lands, and associated increases in rural income; as well as the benefits of reduced climate impacts. In terms of air pollution, for example, fossil fuel-related emissions lead to an estimated 3.7 million premature deaths globally each year, with millions more suffering from respiratory illnesses.

Yet Better Growth, Better Climate also stresses that shifting to a low-carbon, climate-resilient economic pathway will not be easy, and will entail additional investment in the short term. Not all climate policies are win-win, and some sectors and businesses will lose out, even where there are overall net gains to the economy. Governments will need to commit to a “just transition”, providing support for displaced workers, affected communities, and low-income households. And the mix of policies used will need to be adjusted to suit different country circumstances. Strong political leadership and the active engagement of civil society and business will be crucial. Broad international cooperation is also vital, particularly to support developing countries in moving towards a lower-carbon and more climate-resilient growth model. A new international climate agreement, including robust financial commitments, is essential to lay a strong foundation for ambitious action in countries at all levels of development.

The world is changing before our eyes. As discussed in Better Growth, Better Climate, new patterns of international production and trade, demographic change and technological advances have dramatically altered the shape of the global economy over the last two decades. “Business as usual” is thus no longer an option. Structural change is inevitable – but that change can be steered to make economies at all levels of development stronger, more equitable, more sustainable and more resilient.

Several emerging trends and developments offer new opportunities to accelerate the transition to low-carbon growth and prosperity. In this section we highlight six: rapid innovation and declining costs of clean energy technologies; the fall in oil prices as an opportunity to advance carbon pricing and fossil fuel subsidy reform; growing international attention to infrastructure investment, particularly in the context of low interest rates; heightened awareness of climate risks in the financial sector; rising interest in low-carbon growth pathways in emerging and developing economies; and an acceleration of the decline in the carbon intensity of the global economy.

These trends and developments are happening at all levels, from the global, to the regional and to the local. They are being spurred by leading companies, major cities and enlightened governments. None is decisive in itself, and in each case, major barriers and challenges still need to be overcome to achieve large-scale and lasting change. But as discussed in Section 1.2, international and multi-stakeholder cooperation can play a key role in helping overcome these challenges.

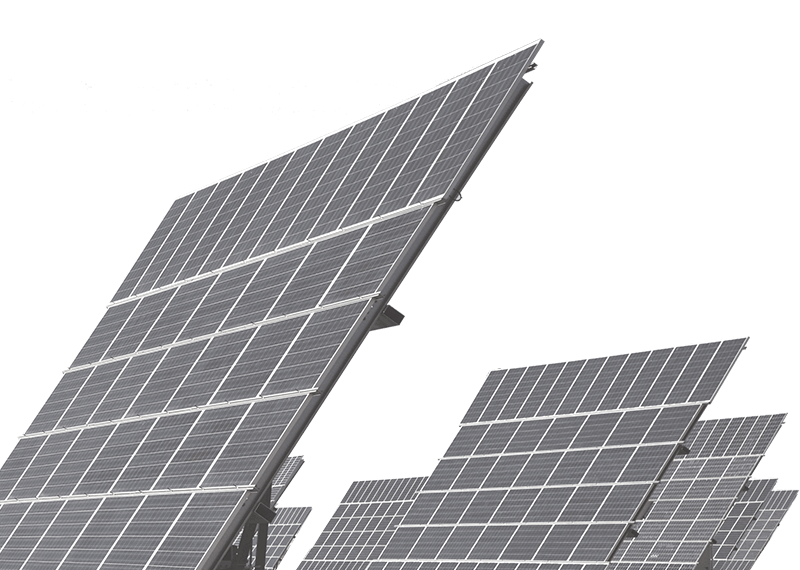

In November 2014, a new price benchmark for solar photovoltaics (PV) was set in Dubai: a bid of just under US$60 per MWh in response to a tender from the state utility DEWA.1 While these are record lows, the cost of solar power systems globally has fallen by 75% since 2000, while that of energy storage has fallen by 60% since 2005 alone. In a wide range of geographies, utility-scale solar PV is being procured for about US$80/MWh.2 This corresponds to natural gas prices in the range of US$7–10 mmbtu – still higher than the US$2–3/mmbtu seen in the shale-rich US in early 2015, but lower than the US$9–10/mmbtu prevailing in Germany and US$14–15 mmbtu in Japan.3 This means that in an ever-growing number of countries, solar PV is now competitive with fossil fuels. A similar story can be told for wind power.4

As a result of these falling costs, every dollar invested in renewables buys more capacity than ever: the US$270 billion invested in 2014 bought 36% more capacity than the US$279 billion invested in 2011.5Experts predict that a further rise in the competitiveness of renewable energy is now only a few years away as a result of plunging energy storage costs. The recent emergence of advanced low-cost batteries for homes, industry and utilities,6along with the rapid development of smart systems using digital and information technologies, is enabling the sophisticated management of demand at every level from the grid as a whole to individual homes. Radical new energy business models are now in prospect, with the potential to lead to a step-change in overall energy productivity.7

One result of these trends is that the share of new renewables (excluding hydropower) in electricity generation worldwide is rising – from 8.5% in 2013 to 9.1% in 2014, when renewables contributed 48% of the world’s newly-added generating capacity (see Figure 1).8It is still not enough, but almost everywhere in the world renewable investment is growing rapidly.

Yet investment in fossil fuels also continues: in 2014, more than 1,300 GW of coal-fired capacity was in construction or pre-construction stages around the world, and major investments are being made in new sources of oil and gas.9At the current rate of increase of about 0.6–0.7 percentage points a year, the share of renewables in total electricity generation would still only reach 20% by 2030 – considerably less than the 41% which the IEA suggests is needed to hold global warming to under 2°C.10The speed of change is inhibited by several factors: continuing challenges raising the financing needed to invest in renewables; the difficulty of reforming energy markets and regulatory arrangements to enable the integration of intermittent renewables into electricity systems at scale; and continuing fossil fuel subsidies and weak or absent carbon prices, which keep fossil fuel energy prices artificially low. But in turn these challenges are spurring new efforts at overcoming them, in both national policymaking in many countries and through various forms of international cooperation. We discuss these below and in Part 2.3.

Figure 1. Annual additions to global power generation capacity (GW)

Source: Liebreich, M., 2015.11

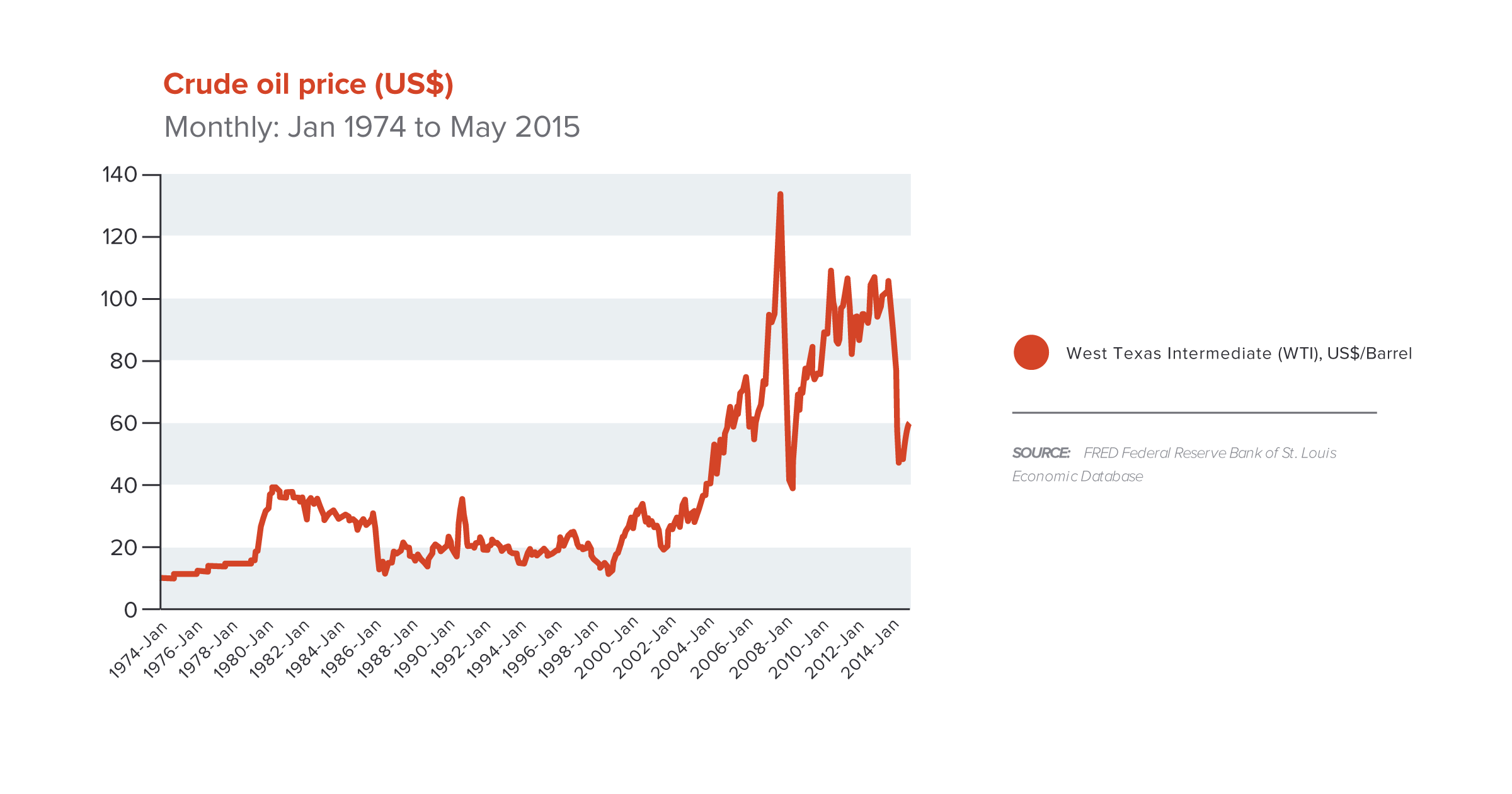

Global oil prices fell by half between the middle and end of 2014 (Figure 2). At first sight, this might not seem like an opportunity for lower-carbon growth. In fact, it has raised demand for oil and gas to some extent. However, lower oil prices have also created an opportunity to pursue much-needed policy reforms. Low prices make it easier in particular for governments to reform fossil fuel consumption subsidies and adopt more efficient frameworks for energy taxation, while still keeping fuel prices affordable.

It is unclear how long this opportunity will last. There are multiple causes for the recent fall in prices, including the growth in unconventional sources such as shale oil, sluggish world demand, changes in the Organization of the Petroleum Exporting Countries (OPEC) price determination policy and a stronger US dollar. Empirical analysis suggests that supply factors played the biggest part in the recent price drop.12 Modelling suggests that the oil price decline may increase global GDP by 0.3–0.7% in 2015, and by 0.2–0.8% in 2016.13 However, there is little consensus on the medium-term direction of oil prices, and price predictions are in any case frequently inaccurate. What can be said is that large swings in the oil price of 25–50% over a short period are quite common, and such volatility is likely to continue. Volatility and the increased uncertainty it brings are economically harmful in their own right, delaying business investment and requiring costly reallocation of resources.14

Figure 2. Crude Oil Price. Source: FRED Federal Reserve Bank of St. Louis Economic Database.15

Initially, there were understandable fears that the drop in oil prices might halt the rising demand for alternatives to fossil fuels, such as improved energy efficiency, renewables and electric vehicles. But this now looks unlikely, given the momentum of innovation and falling costs in renewable energy and energy efficiency. Indeed, greater energy efficiency and reliance on clean energy will provide an important hedge against the risk of much higher oil prices in the future. Nevertheless, countries may need to adjust their support for clean energy in the near-term to ensure that its long-term benefits are not disrupted by the near-term decline in oil prices.16 Enhancing international efforts to bring down the cost of capital for renewable energy and raising energy efficiency standards, as we discuss in Sections 2.3 and 2.4, will be particularly important.

A number of countries are taking advantage of the low oil prices to accelerate fossil fuel consumption subsidy reforms and the adoption of carbon pricing through carbon emission trading schemes (ETS) or carbon taxes. These reforms can help offset the near-term incentives for more fossil fuel consumption created by low oil prices, while yielding important long-term benefits for economic efficiency, energy security, government budgets, cleaner air and reduced climate risk, especially given the high volatility and uncertainty of oil prices in the future.17 With the right approach and flanking policies to address social impacts, these reforms can be maintained even if oil prices increase. This is discussed further in Section 2.5.

As of 2015, about 40 countries and 20 sub-national jurisdictions representing almost a quarter of global GHGs have explicit carbon pricing policies in place or planned.18 Taken together, the carbon pricing instruments in these jurisdictions currently cover about half of their GHG emissions, equivalent to 7 Gt CO2e, or about 12% of global GHG emissions – triple the 4% covered in 2005. Important recent developments include the successful operationalization of pilot trading schemes in seven cities and regions in China, with a national ETS to be launched in 2016; the introduction of Korea’s ETS in 2015; and the successful linking and expanding of the regional trading schemes in California and Quebec in 2014. They will be joined this year by Ontario.19 Chile and Portugal have adopted carbon taxes, and South Africa plans to introduce one in 2016. India has increased excise taxes on diesel and petrol, representing an increase in implicit carbon prices.

It is clear that these reforms, while nationally determined, are mutually reinforcing, each making it easier for others to be introduced, as fears over competitiveness impacts are reduced and a sense of a “new policy normal” is created. As we note in Section 2.5, the various international initiatives now under way to build political support for carbon pricing, including among businesses, have the potential to expand its use much further.

Fossil fuel consumption subsidies in emerging and developing economies totalled US$548 billion in 2013, while fossil fuel exploration, production and consumption subsidies in OECD countries amount to US$55–90 billion a year.20 But some 28 countries are now undertaking energy subsidy reforms, with reductions in consumer subsidies in countries such as Mexico, Egypt, Indonesia, Ghana, and India. Several others are considering additional steps, including Morocco and Jordan.21 Lower oil prices have made this easier, though the political challenges remain formidable. In terms of production and exploration subsidies, low oil prices have, if anything, increased the pressure to maintain support. What countries undertaking reforms have almost all found, however, is that, while fossil fuel consumption subsidies are often introduced as a form of social protection, they are in practice regressive, with the richest 20% of the population typically capturing 40–50% of subsidy benefits, while the poorest 20% usually get much less than 10%.22 Well-targeted cash transfers provide more effective and efficient social protection for the poor, and many countries are now benefiting from the learning of others as policy practice spreads internationally (see Section 2.5).

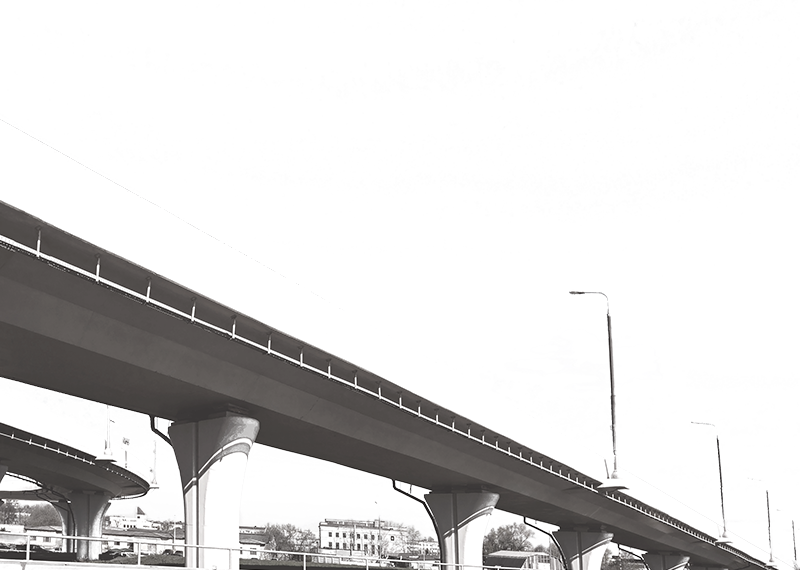

Infrastructure investment has risen to prominence on the international economic agenda in recent years. At its Brisbane Summit in 2014 the G20 established a new Global Infrastructure Initiative, along with an implementing “Infrastructure Hub”, with the aim of catalysing both public and private investment.23 Around the same time, the World Bank launched a Global Infrastructure Facility with other multilateral development banks and private sector investors to help deliver major infrastructure projects in low- and middle-income countries.24 New multilateral and national development banks are being established with a specific infrastructure focus, notably the Asian Infrastructure Investment Bank25 and the New Development Bank.26 There is increasing interest in catalysing private financing of new infrastructure, particularly among institutional investors such as pension funds and insurance companies.27 This is also a growing focus of the international discussions around Financing for Development, as we discuss below.28

Better Growth, Better Climate estimates that the world will need some US$90 trillion of infrastructure investment in 2015–30 (an average of US$6 trillion a year), concentrated in cities, energy and land use systems. But it points out that the choice of infrastructure is critical. Many forms of infrastructure, including roads, public transport systems, power plants, water management systems and urban buildings make significant contributions to GHG emissions, and they are also particularly vulnerable to the rising incidence of extreme weather events. If long-lived investments are made without attention to wider impacts, such as on energy security, air pollution, GHG emissions and resilience to climate damage, the world will become locked into a carbon-intensive development path with severe risks to both growth and climate. Building low-carbon infrastructure would require not much more capital, perhaps an additional US$4 trillion of investment (around 5% more), and this could well be largely or completely offset by longer term operational savings on fossil fuel costs.

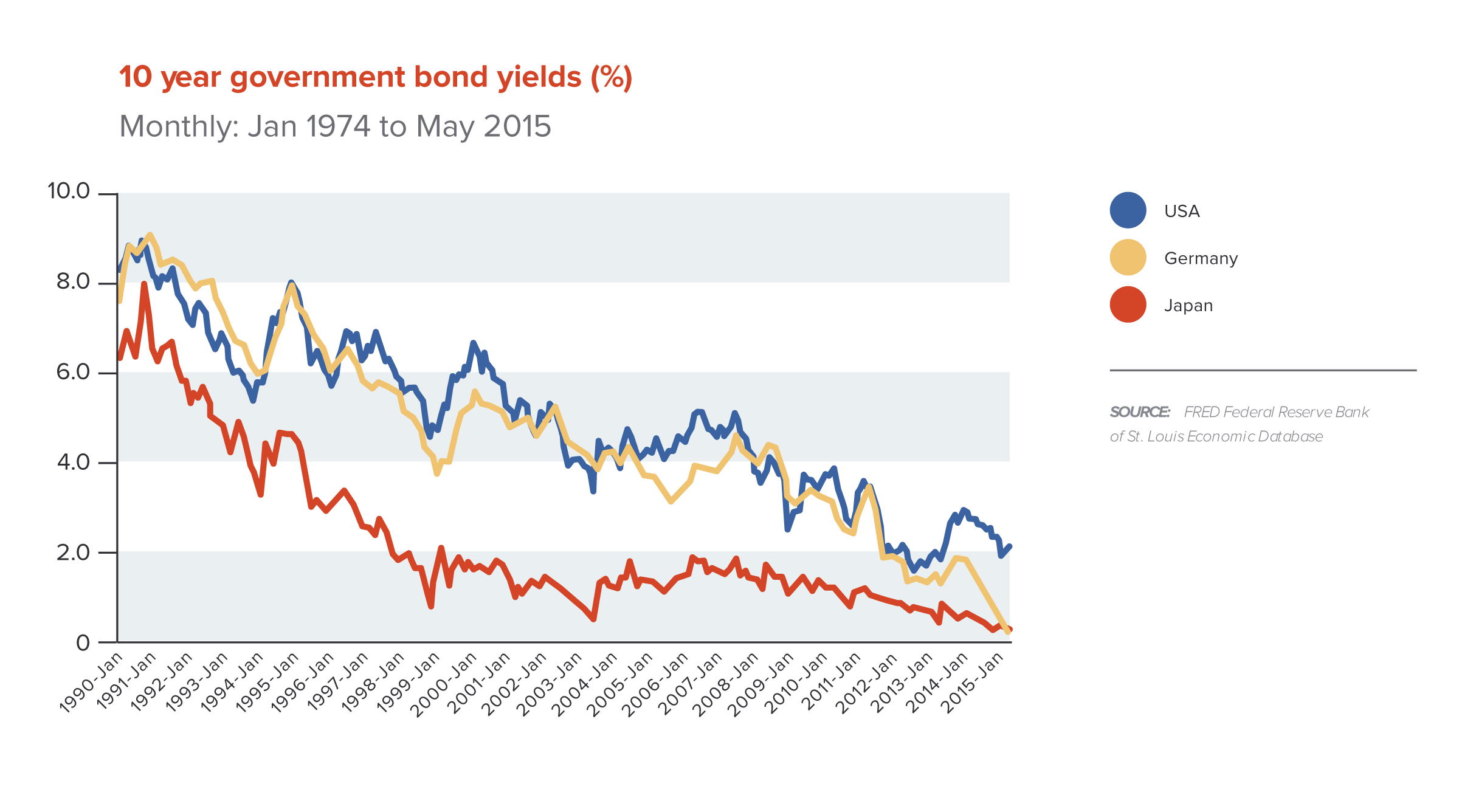

Extremely low long-term real interest rates in many advanced economies provide an extraordinarily favourable financing environment for infrastructure investment. In March 2015 the real interest rate on 10-year US government borrowings was less than 0.3% (as reflected in yields on inflation protected securities). In Germany and Japan the nominal yields on 10-year government bonds were below 1% (Figure 3), which, given inflation expectations, constitute effectively zero or negative real interest rates. Given the likelihood that interest rates will rise over coming years, this presents a major and probably time-limited opportunity to finance new infrastructure at very low cost. 29

Increasing investment in infrastructure is a powerful way to boost global economic growth, which remains mediocre. It can stimulate short-term demand in economies where it is weak, and ease supply bottlenecks and expand potential output elsewhere. Recent estimates by the International Monetary Fund (IMF) indicate sizeable and long-lasting impacts of public infrastructure spending on private investment and output. These effects are significantly larger during periods of slow growth and in countries with high public investment efficiency, which is critical to ensure that resources are not squandered on “white elephant” projects. Other studies document the impact of infrastructure in reducing poverty and distributional inequity in developing countries.30

Given the critical need to replace old and often crumbling infrastructure in the developed world, and the huge deficit in infrastructure spending in most developing countries, this creates a major opportunity to drive global growth. Calderon, C., and Serven, L., 2014. Infrastructure, Growth and Inequality: An Overview. World Bank Group, Washington, DC. Available at: https://openknowledge.worldbank.org/handle/10986/20365.[/footnote] But it has to be “climate-smart” – both low-carbon and climate-resilient. As we discuss in Section 2.6, it would be extremely short-sighted to build infrastructure which is immediately vulnerable to climate change impacts and/or to more stringent climate policy in the future.

Figure 3. 10 Year Government Bond Yields (%). Source: Federal Reserve Bank of St. Louis Economic Database.31

The low real interest rates that advanced economies are enjoying are not being seen in most developing countries, which continue to face significantly higher market borrowing costs or are excluded from international capital markets altogether. Thus a major priority is to strengthen international collaboration on expanding the flow of climate-smart infrastructure finance to developing countries, as well as to tackle specific institutional and policy problems and uncertainties that inhibit private infrastructure investment.32 These efforts should include technical and other assistance to help low-income countries strengthen their public investment management frameworks and capacities.33

There is growing interest in climate risk within the financial sector. This is perhaps unsurprising in the global insurance industry, where climate risk is now widely integrated into both underwriting products and investment strategies. To increase risk transparency, the industry has embarked on a “1 in 100” initiative to develop climate risk metrics for one-in-100-year catastrophic events to be applied across private and public sector actors.34 In the US, insurance regulators in several major states are implementing an annual Insurer Climate Risk Disclosure Survey.35 But action is now spreading. Central banks, financial sector regulators, capital market authorities and finance ministries are also now beginning to include consideration of climate risks in the rules governing financial systems. The aim is to send clearer signals to financial markets, better aligning incentives for private investors with the true social cost of investment in fossil fuels and the benefits of clean investments.

The Bank of England, for example, is studying the impact of climate risks on the UK financial system, including both physical risks (such as catastrophic weather events) and transitional risks (related to the speed of transition to a low-carbon economy), while the Bank’s Prudential Regulation Authority is reviewing the implications of climate change for the safety and soundness of insurance companies. Brazil’s Central Bank has issued requirements for all banks to introduce systems for assessment of climate and other socio-environmental risks. A small but growing number of countries now have legal requirements for institutional investors to report on how their investment policies and performance are affected by environmental factors, including South Africa and, prospectively, the EU.36 Concern about the risks of a “carbon bubble” – that highly valued fossil fuel assets and investments could be devalued or “stranded” under future, more stringent climate policies – prompted G20 Finance Ministers and Central Bank Governors in April 2015 to ask the Financial Stability Board in Basel to convene an inquiry into how the financial sector can take account of climate-related issues.37

Investors more generally are starting to become engaged. Following the passage of shareholder resolutions requiring BP and Shell to disclose their climate risks and strategies in spring 2015,38 62 institutional investors representing nearly US$2 trillion in assets called on the US Securities and Exchange Commission to push for better disclosure of such risks by oil and gas companies in general.39 Others are now divesting from fossil fuel assets, particularly coal. Over the past three years more than 220 institutions, including colleges and universities, cities, religious institutions, pension funds, foundations and others have committed to such divestment.40 In May 2015, Norway’s sovereign wealth fund, one of the top 10 investors in the global coal industry, announced it would withdraw up to US$10 billion of investment from companies heavily reliant on coal.41

At the same time as attention to climate risk has been rising, there has also been increasing concern to ensure that financial systems are adequately structured to invest in the low-carbon economy. The UN Environment Programme’s Inquiry into the Design of a Sustainable Financial System is conducting a two-year examination with the support of central banks and financial regulators across the world.42 China is already working on a comprehensive framework for a “green financial system”, including strengthening legal frameworks, improving information, increasing fiscal and financial policy incentives and developing its national development banks as leaders in green finance.43

Countries and jurisdictions such as Brazil, China, the European Union and India are also reforming regulations and incentives in order to promote the development of markets for “green bonds” and other investment vehicles for environmental and low-carbon infrastructure and assets. Issuances of green bonds (corporate, municipal or institutional bonds with proceeds earmarked for an environmentally-friendly project, or project bonds issued specifically with the backing of clean energy projects) have grown rapidly in recent years, from less than US$5 billion per year in 2007–12 to US$11 billion in 2013 and US$37 billion in 2014. Other investment vehicles are also expanding rapidly. In just two years, 15 “YieldCos” (publicly-traded companies paying dividends to shareholders from portfolios of owned renewable energy projects) have been set up in the US, Canada and Europe, with a total market capitalization of well over US$20 billion.44 Several major global banks have made public commitments to increasing their investments in environmental and climate-related projects, including Bank of America and Citigroup.45

These are positive trends, yet they remain small relative to total global financial flows. There is thus great scope to scale up international financial initiatives to increase the capital allocated to low-carbon investment. We discuss this further in Section 2.3.

A growing number of developing and emerging economies are building “green growth” and environmental sustainability into their national development and poverty reduction strategies. This reflects a recognition that countries in a wide range of economic circumstances can achieve their development goals through more sustainable approaches than others have pursued in the past.46

Rwanda, for example, a least developed country, adopted a Green Growth and Climate Resilience Strategy in 2011, aiming to mainstream climate goals into its economic development and poverty reduction plans. It aims for Rwanda to become a developed country by 2050, based on its renewable energy resources, particularly geothermal; integrated soil fertility management in its agricultural sector; and the development of high-density, “walkable” cities.47

Ethiopia, another least developed country, adopted a Climate Resilient Green Economy (CRGE) Initiative as part of its Growth and Transformation Plan (GTP) for 2010–25.48 It seeks to secure “triple wins”: simultaneously raising productivity, strengthening climate resilience and reducing GHG emissions, and tries to address trade-offs between these objectives. It includes initiatives to disseminate efficient cookstoves, and to introduce new soil management methods and agricultural technologies to raise yields and reduce emissions from agriculture, which will also reduce deforestation pressures. At the same time, as part of the drive to achieve middle-income status by 2025, the GTP aims to dramatically increase power generation capacity and energy access by exploiting the country’s considerable renewable power potential, through hydroelectric power, wind, geothermal and biofuels.

Increasing energy production to achieve universal access and also support economic growth is a key development challenge for almost all countries in sub-Saharan Africa and for several in Asia, including India. In its 2015 report, the independent African Progress Panel led by Kofi Annan argues that the huge need to expand energy production in Africa will inevitably require continuing use of fossil fuels, including coal.49 But the report also finds that Africa could “leapfrog” over the fossil fuel-based growth paths of developed countries and should aim to become a leader in low-carbon development, exploiting its abundant – and still barely utilised – renewable energy resources. This would require a significant increase in energy investment, amounting to around 3.4% of Africa’s GDP. Countries such as Brazil have shown how energy supply can be increased rapidly; others such as Kenya and Bangladesh are pioneering new approaches to financing decentralised solar power.50 For example, Grameen Shakti operates a microcredit model that has financed more than 220,000 solar home systems and 30,000 energy-efficient cookstoves in Bangladesh.51 But achieving the UN goal of universal access to energy by 2030 will require the support of the international community, including a significant scaling-up of finance and technical assistance. We discuss this further in Section 1.3.

China offers perhaps the most striking example of new policies. It has now embarked on a historic structural transformation that has global implications: both directly, because of China’s role in the world economy, and indirectly, by the lessons it provides to other developing countries. China is moving away from a development model based on rapid growth in capital accumulation and energy-intensive export industries, powered largely by coal. It is seeking to move towards an economy based on growth in domestic consumption and services, with stronger innovation and more efficient resource use, powered increasingly by cleaner forms of energy. At the same time it is trying to reverse old patterns of urbanisation, which resulted in sprawl and rising air pollution. China’s leaders have listed what they describe as building an “ecological civilisation” as one of the country’s five top priorities guiding reforms. Severe air pollution is a key driver. In September 2013 China banned construction of new conventional coal-fired power plants in major economic areas, and in 2014 it instituted a national cap on coal consumption. Coal consumption in 2013–14 is estimated to have grown by only 0.1%, and may now have peaked.52

At the same time, strong measures are being implemented to promote energy efficiency and expand nuclear, hydro, solar and wind power generation; China now has the most installed wind power and second most solar PV in the world.53 Among the seven “strategic emerging industries” prioritised for economic growth in the government’s 12th Five Year Plan (2011–16), five are environmental sectors, including new energy sources, energy conservation and clean vehicles.54 China remains heavily coal-dependent, and its global growth is a major source of rising GHG emissions, but this is a serious shift in the form of its economic development.

These examples – and others in very different contexts, such as in Colombia, Costa Rica, South Korea and Indonesia – are indicative of a more widespread shift in the understanding of development paths. An increasing number of developing and emerging economies are coming to view environmental sustainability and climate action as integral elements of their growth strategies. But international cooperation – through increased flows of knowledge, financing and other resources – will for most developing countries be critical if these strategies are to be realised.55

The International Energy Agency (IEA) estimates that global CO2 emissions from fossil fuel combustion held steady at about 32 Gt in 2014, the first time in 40 years that a halt or reduction in global emissions has not been associated with an economic crisis.56 Global GDP, meanwhile, grew by just over 3%. This means that the CO2 intensity of global GDP also fell by just over 3%. Examining these trends and future options, the IEA observes that, while definitive conclusions cannot be drawn from a single year, there are now positive signs that climate change mitigation efforts have the potential to decouple growth from emissions over the coming period.57

Although detailed information is not yet fully available, declines in China’s coal consumption and CO2 emissions in 2014 appear to have been an important contributor to the apparent halt in global emissions growth, the result of strong policies to reduce air pollution, curb coal use, promote energy efficiency and expand low-carbon power generation capacity.58 Efforts to increase carbon pricing, boost energy efficiency and shift to renewable energy are also helping to decouple CO2 emissions from growth in both advanced and a range of emerging and developing economies. The reduction in the CO2 intensity of global GDP adds to the growing body of evidence that countries can reduce GHG emissions while sustaining economic growth.

However, climate risk is still rising. The level of emissions remains extremely high, and it is still too early to conclude that it has stabilised. The IEA’s 2 degrees scenario (2DS) – defined as an emission pathway which gives at least a 50% chance to keep the mean temperature increase below 2°C – provides a measure of the challenge ahead. The specific pathway explored by the IEA would entail reducing CO2 emissions from energy consumption by almost 60% to reach 14 Gt CO2 by 2050, with a decline to zero net emissions in the second half of the century. To get there, the IEA estimates that the world energy-intensity of GDP (broadly reflecting energy efficiency) and the carbon-intensity of primary energy consumption (broadly reflecting the share of fossil fuels in the energy mix) would both need to fall by 60% from 2012 to 2050, or by around 2.6% per year. The sum of these two measures is reflected in the CO2-intensity of GDP. In the IEA’s 2DS scenario, which assumes an average annual global growth rate of just over 3%, the CO2-intensity of GDP would need to fall by close to 85% from 2012 to 2050, or by a global average of 5.3% a year.59 For developing countries, improving emissions intensity allows for strong GDP growth while total emissions peak and then ultimately decline.

| Table 1. Growth in World CO2 Emissions from Energy and its Drivers | |||

| 1980–2000 | 2000–2010 | 2010–2014* | |

| Annual average growth (%) | |||

| CO2 Emissions | 1.5 | 3.2 | 1.9 |

| GDP | 3.1 | 3.8 | 3.2 |

| CO2-Intensity of GDP | -1.5 | -0.5 | -1.3 |

| Energy-Intensity of GDP | -1.3 | -1.2 | -1.4 |

| CO2-Intensity of Energy | -0.2 | 0.7 | 0.1 |

| Sources and methods60*Estimates including NCE staff estimates for incomplete data. | |||

Table 1 documents recent trends in world CO2 emissions and three drivers: GDP growth, the energy-intensity of GDP and the CO2-intensity of energy. Carbon dioxide emissions growth did slow significantly, from 3.2% per year in 2000–2010, to 1.9% in 2010–2014. Notably, a little over half of this decline was due to an accelerating decline in the CO2-intensity of GDP, to an estimated average of -1.3% per year in 2010–2014. Because of incomplete data, we are less certain about recent trends in the components of the CO2-intensity of GDP. Nevertheless they are moving in the right direction. The pace at which the energy-intensity of GDP is falling appears to have picked up modestly, to perhaps -1.4% a year in 2010–14. The CO2-intensity of energy – the “dirtiness of the energy fuel mix” – was actually rising by around 0.7% a year in 2000–2010, primarily due to rising fossil fuel use in developing countries. However, CO2-intensity growth appears to have slowed significantly in 2010–2014, and may even have stabilised. But the challenge is clear. Although GHG emissions are gradually being decoupled from growth rates, they are not doing so at anything like the rate required to put the world on a 2°C path.

This makes the need for both low-carbon and climate-resilient development strategies even more urgent. Growth in developing economies has steadily decelerated from 2010 to the present, and remains weak in advanced economies. World trade is growing at less than half its pre-crisis trend,61 and there are concerns that global poverty reduction, which accelerated in the first decade of the 21st century, is now slowing down.62 A billion people still live on less than US$1.25 a day, now largely concentrated in sub-Saharan Africa and South Asia, with around 2.4 billion on less than US$2 a day.63 Yet the continued rise in climate risk is most threatening to the global poor, who are particularly vulnerable to the impacts of climate change. Indeed, the warming towards which the world is currently headed, of 3°C or 4°C or more, could effectively reverse much of the development progress made over the last half century.64 Adaptation programmes designed to increase resilience to climatic changes must therefore be an integral part of development and poverty reduction strategies, and need much greater attention and financing.65 Yet adaptation alone is not enough, for without strong and early mitigation action, temperatures will continue to rise.

Both the need and the opportunity are therefore very great. By instigating a step-change in the rate of investment, particularly in infrastructure, and by ensuring that this is both low-carbon and climate-resilient, the international community has the potential to achieve multiple goals at once. It can stimulate global growth, restore progress on development and poverty reduction, and tackle climate risks. This will require serious and sustained attention to policy reform. Major obstacles – the protracted effects of the global financial crisis, the inheritance of deeply embedded market failures, weaknesses in policies and institutions, and the momentum of a high-carbon economic model built up over the last 150 years – all continue to inhibit stronger economic performance. But the potential, and the prize, are large.

These six recent trends and developments are all encouraging, but it is clear that none is yet occurring at a scale or pace sufficient to create a decisive shift in the direction of the global economy. As argued in Better Growth, Better Climate, national governments need to focus attention on the policies and institutions which can drive the necessary reforms: increasing resource efficiency, raising infrastructure investment and stimulating innovation, particularly in the three economic systems of cities, land use and energy. Box 2 summarises lessons learnt from different countries about best practices in policy-making for low-carbon growth.

Both the World Bank and the OECD have recently published studies bringing together learning and experience of successful policy-making for low-carbon growth.66 The World Bank identifies three core principles. First, policy-makers need to plan with an eye on the long term. There are different ways to achieve short-term emissions reductions. But if the end goal is decarbonisation, it is vital that decisions now do not lock in high emissions in the future. Understanding the multiple economic, social and environmental benefits of low-carbon action, as Better Growth, Better Climate argues, can help long-term decision-making.

Second, carbon pricing is important, but has to be part of a wider policy package that triggers far-reaching changes in investment patterns, technologies and behaviours. The OECD shows how better alignment and integration of national policies and regulatory frameworks across ministries and sectors offers huge potential to achieve stronger impacts and reduce costs.67 In many countries, misaligned policies are common, making policy goals much harder to achieve. A case in point is the continuing subsidisation of fossil fuel production and consumption even in countries with climate change mitigation policies. But there are many other areas where better alignment is possible, from financial prudential frameworks that inadvertently discourage long-term investment, to the continued decline in funding for energy RD&D as a share of total RD&D spending. Aligning policies in specific sectors is also important – for example, in electricity markets and urban public transport.

Third, managing the political economy of change is critical. As Better Growth, Better Climate argues, governments need to ensure that the shift towards a low-carbon economy is a “just transition”. Not all climate policies are “win-win”: although many jobs will be created, and there will be larger markets and profits for many businesses, some jobs will also be lost or need to evolve, particularly in high-carbon sectors. The human and economic costs of the transition should be managed through local economic diversification plans and support for displaced workers, affected communities and low-income households. Adequate social protection will be needed, along with active labour market policies to assist retraining and redeployment where necessary. Social dialogue and democratic consultation of social partners (trade unions and employers) and communities is important to ensure acceptance and trust. National transition plans are a valuable first step.68

National policy is critical. But the impact of national action can be greatly amplified when markets become global. The story of solar power provides an illustration. The dramatic reduction in the cost of solar PV over the last decade arose not just from advances in technology, but from governments’ policy choices. The introduction of a solar feed-in tariff in Germany in 1991 led to a rapid rise in demand over the following two decades, while investment in solar manufacturing in China enabled costs to fall and supply to be expanded. The result has been the creation of a global market, expected to be worth around US$75 billion in 2016 (up from just US$40 billion just five years before),69 with solar power in various uses now affordable throughout the world.

These and other examples – such as the comparable reduction in the costs of LED (light emitting diode) lighting over the last decade, and the rapid spread of mobile phones in Africa, which are making landlines increasingly obsolete – show how the creation of global markets and new business models can help transform individual technologies and national policies into dramatic agents of change, reducing costs, driving innovation and catalysing widespread dissemination.

Many of these processes have occurred without a deliberate process to drive them. But in many other cases, cooperation among governments and multiple other stakeholders – businesses, international organisations and civil society – has played a crucial role in scaling up and accelerating transformative change.

First, such cooperation can be a powerful way of expanding markets and reducing costs. For example, over the last two years, international trade negotiations have moved towards reducing tariffs on low-carbon goods and services.70 Convergence of national energy efficiency standards for appliances and industrial equipment can equally expand the available markets for national producers and reduce the transaction costs of exporting. Collective procurement of low-carbon goods and services by a number of city authorities and governments – in fields such as electric buses or low-carbon construction materials – offers another cooperative route to scaling up demand and cutting costs.

Second, for countries concerned that standards, carbon pricing or other climate policies could affect their international competitiveness, international cooperation can help overcome these anxieties. If multiple countries – particularly competitors – act together, this can help keep the playing field level. The same is true among businesses in globally traded sectors, which may find it difficult to take ambitious action alone. In both business and the public sector, leadership associations and “clubs” have helped support pioneers to take bolder action, both spurring them on and protecting them against internal criticism. When there is public scrutiny, the power of example can begin to change the norms of behaviour even where action is voluntary. Yet public policy reinforcement is also needed; for example, it is notable that the Tropical Forest Alliance 2020, which is working to eliminate deforestation from commodity supply chains, is not just a business coalition, but also involves governments in both forest and importing countries.

A third key benefit of international and multi-stakeholder cooperation is that it can enable extensive knowledge-sharing and capacity-building, and help identify and disseminate best practices. Opportunities for action on climate change are constantly developing, leading to a lot of “learning by doing”. Many international cooperative initiatives are already facilitating the exchange of information on technologies, standards, policies and business models for climate action. They have particular value in scaling up solutions, and in transferring knowledge across countries and sectors. While historically, this has mostly involved North-South cooperation, there has been a rapid rise in South-South cooperation in recent years.

Fourth, and crucially, international cooperation is essential for expanding finance flows, particularly to the poorest countries and to sectors and activities that may not, on their own, attract sufficient private investment. This is one of the most important forms of intergovernmental cooperation, and another area where South-South cooperation is growing.71 The multilateral development banks, UN agencies and other international organisations and partnerships are particularly important institutional vehicles for financial flows and capacity-building, with their strong capabilities in technical assistance. Achieving new agreements for future flows of both public and private finance to support sustainable development is a vital priority for both the Financing for Development and COP21 processes in 2015 (see Box 3). As we discuss in Section 2.7, financial cooperation is also important in the field of research, development and demonstration (RD&D), allowing countries and businesses to share the costs of accelerating and disseminating new technologies.

The major international meetings being held this year – the International Conference on Financing for Development in July, the United Nations Summit to adopt the post-2015 Sustainable Development Goals (SDGs) in September, the G20 Summit in November, and the UN Climate Change Conference (COP21) in December – provide critical opportunities to scale up investment to deliver both development and climate objectives.

In all these arenas it is crucial to take an integrated approach to building finance frameworks, so they can deliver both development and climate objectives together. While there are important differences of emphasis between the two agendas, the draft SDGs under discussion recognise significant synergies, and these need to be fully realised. Key areas in which the financing framework must be properly integrated include delivery of low-carbon infrastructure; promoting energy efficiency; building climate resilience and adaptation; halting deforestation and reversing land degradation; and fostering innovation.

Scaling up finance that supports both development and climate objectives will entail expanding domestic resource mobilisation, both public and private: this is an important need in many developing countries. But it also requires much larger international flows, in particular to developing countries, from both public and private sources. The role of multilateral and regional development banks in infrastructure, climate and other development financing needs to be significantly expanded, along with their support for efforts to establish and strengthen domestic policy frameworks. This should include increasing their capital base, allowing greater flexibility in the management of their balance sheets and streamlining decision procedures, alongside wider efforts to mainstream both climate change into investment strategies and development objectives into climate financing. (This is discussed further in Sections 2.3 and 2.6.)

While clean energy funds and other development financing vehicles have expanded greatly in recent years, more can be done. Institutional and policy problems that inhibit private investment in infrastructure and low-carbon projects urgently need to be tackled. Developing bankable projects that have the right risk-return profile to attract private-sector finance remains a challenge. Some of the solutions include more stable policies to reduce investor uncertainty, as well as development of risk-sharing instruments, blended finance approaches and reform of financial sector regulations to increase the demand for clean infrastructure assets in institutional investor portfolios.72 (This is discussed further in Section 2.3.) This will require strengthening institutions and policies for both public revenue and expenditure, as well as promoting development of local capital markets and financial systems. The outcomes of the Addis Conference on Financing for Development, where countries will agree how to finance delivery of the SDGs, should launch efforts to deliver on this agenda.

It is within this broader context that countries meeting at the UN Climate Conference in Paris need to agree on a new climate finance package. In Copenhagen in 2009, and confirmed in Cancún in 2010, developed countries agreed to mobilise US$100 billion per year by 2020 for developing-country climate action, from both public and private sources.73 The Green Climate Fund, an important vehicle for delivering this finance, was operationalised last year after achieving US$10 billion in (multi-year) pledges. But a clearly agreed path on how finance will be increased to US$100 billion per year from these levels is still needed.74 Public finance flows remain critical, particularly for adaptation and strengthening resilience. These funds, in turn, must leverage far greater sums in private investment, both domestic and international.

Continued efforts are needed to improve definitions of climate-relevant investment, to measure, report and verify financial flows and identify mobilised finance, and to understand and improve the effectiveness of such investment on adaptation and mitigation on the ground. A new UNFCCC agreement, as well as collaborative action agreed in other forums, will be essential to trigger wider action to deliver more sustainable infrastructure investment in all countries. For example, it could reinforce commitments to reduce and rationalise fossil fuel subsidies, and strengthen the assessment of climate risks and opportunities in fiscal and financial systems.75

At the centre of international cooperation on climate change is the UN Framework Convention on Climate Change (UNFCCC). Despite slow progress in recent years, negotiations are now well on the way to achieving a comprehensive new climate agreement at the Paris Climate Change Conference (COP21) in December. If countries can reach an agreement involving universal participation, it will be historic, as it will mark the first time that all countries make climate action commitments under the UNFCCC.

Such an agreement is important to create an equitable, rules-based system for the global governance of climate change. But as Better Growth, Better Climate argues, a strong agreement will also provide a clear signal to businesses and investors that the global economy is moving towards a low-carbon pathway. This will help shape economic expectations, spurring investment and innovation in low-carbon and climate-resilient economic activity. It will therefore in itself act to scale up global markets and reduce costs, while at the same time making the risks attached to high-carbon investment more transparent.

Better Growth, Better Climate identifies key features of an agreement which would enhance this signalling effect, summarised in Box 4.

It is not the Commission’s role to recommend the specific design of a new international legal agreement. But building on the conclusions of Better Growth, Better Climate, there are some core features which would enhance the ability of an agreement to send a clear signal to businesses, investors and governments on the future low-carbon and climate-resilient character of the global economy. These include:76

An international agreement will contain many other provisions; this is not intended to be a comprehensive description. But an agreement which included these elements would provide a major boost to international economic confidence.

Over the last 18 months, most countries have been preparing INDCs that set out their national targets, plans and policies beyond 2020 to be included in the Paris agreement; several have already been published.77 In most countries the preparation process for these documents has required a serious – and in some cases unprecedented – analysis of how greenhouse gases are related to growth trends, and how these can be decoupled, absolutely or relatively. In many this represents an important step forward for the integration of climate considerations into mainstream economic planning.

Some INDCs represent historically ambitious commitments that will require considerable domestic effort to implement.78 Nevertheless, initial assessments suggest that it is very unlikely that the mitigation actions pledged will add up to a global emissions reduction consistent with a 2°C pathway. Early estimates suggest that global emissions in 2030, if the current and expected INDCs are implemented, will be around 55–61.5 Gt CO2e (up from 49 Gt CO2e in 2010).79 This would still be well above the median level of emissions (estimated to be around 42 Gt CO2e) needed to have a more than 50% chance of putting the world on a 2°C path. Given the huge costs which would be involved in reducing emissions far more rapidly after 2030 – likely to involve the writing off of many assets – it may in effect risk putting 2°C out of reach.80

Thus it is essential that the INDCs submitted in 2015 are not only as ambitious as possible, but are also seen as the starting point, rather than the limit, of countries’ climate ambition over the coming years.81 This would follow the logic of policy-making: it is evident that policies which affect emissions a decade or 15 years into the future will not cease being made in 2015. Indeed, given the trends discussed in Section 1.1, there are strong reasons to believe that low-carbon options will become increasingly affordable and accessible. As they do so, policy-makers should be encouraged to increase the ambition of their climate targets and policies.

Some have already done this. The EU’s INDC frames its 2030 target as a cut of “at least” 40% on 1990 levels, leaving room for deeper cuts in the context of a successful international agreement. Mexico has explicitly set two targets, one an “unconditional” GHG emission reduction of 25% below business as usual by 2030, the other a “conditional”’ reduction of 40%, which could be achieved subject to progress on a variety of issues such as an international carbon price, technical cooperation and access to low-cost financial resources and technology transfer.82 It would be helpful if this approach could be reflected in the general understanding that INDCs published in 2015 are “floors, not ceilings” – lower bounds to ambition which can be strengthened when circumstances change, either before or after the Paris conference.

International cooperation on climate-related issues has also blossomed outside the UNFCCC – one of the most significant developments in recent years. This includes increased attention to climate action in other multilateral processes, such as the development of the SDGs (which include a proposed goal on climate change as well as others related to it), discussions on Financing for Development, and under the G7 and G20. But it also goes well beyond these intergovernmental processes. Multi-stakeholder initiatives have been launched on renewable energy, energy efficiency, transport, cities, agriculture, forests, short-lived climate pollutants, finance and adaptation, among others.83 Many of these were showcased at the UN Climate Summit in New York in September 2014, an unprecedented gathering of government, business and civil society leaders.84

At the Lima Climate Change Conference in December 2014, the Governments of Peru and France, in association with the UN Secretary General and UNFCCC Secretariat, launched the “Lima-Paris Action Agenda”, aiming to provide a platform for multi-stakeholder climate solutions at the Paris conference.85 The UNFCCC Secretariat has established a portal where actions by non-state actors and international cooperative initiatives are registered and recognised, backed by an independently compiled database.86 Serious efforts are now being made to produce methodologies by which these actions can be properly measured and assessed.87

Many of these initiatives are relatively new and still in development, however, and participation remains relatively narrow. A major expansion of cooperation is both possible and vital, if the full range of opportunities for growth-enhancing climate action are to be realised. This report in particular highlights 10 areas of international and multi-stakeholder cooperation with significant potential. In some, there are already initiatives with considerable momentum, but which need wider participation to have significant impact. Others represent opportunities that have yet to be seized. The initiatives fall into four broad categories:

The areas identified in this report do not exhaust the full range of available opportunities for partnership or cooperation. But in each of them cooperative action could generate significant economic benefits and emission reductions – and there is potential for key commitments to be made this year or next. The first criterion is critical: in each case, there are powerful reasons for governments, cities, businesses and others to work together to implement the proposals, even without consideration of their climate impact. They will have economic benefits – both in terms of growth, employment and poverty reduction, and more broadly through improved air quality and public health, reduced congestion, improved quality of life, and more. In short, they can help generate “better growth” as defined in Better Growth, Better Climate.

The analysis here has also estimated their climate benefits, where possible. The methodology and numbers are explained in a separate Methodology Note.88 It is of course not the international cooperation itself which has the mitigation potential; it is the policies and investments themselves. But cooperative partnerships can help catalyse and support that action. Some of the actions overlap with one another in terms of their impacts on emissions; these have been subtracted to arrive at the total potential.

Overall, if the recommended actions were implemented, the analysis suggests that global GHG emissions in 2030 would be 16–26 Gt CO2e lower than under a “business as usual” scenario, i.e. if current trends were to continue with no new policies introduced. This represents between 59% and 96% of the reductions likely to be needed by 2030 to put the world on a pathway consistent with holding global warming to 2°C (see Figure 4).89

Figure 4: The Commission’s recommendations could achieve up to 96% of emissions needed to keep climate change under 2°C. Source: New Climate Economy analysis.90

This shows that the emissions reductions envisaged in INDCs are only a fraction of the economically beneficial options for climate mitigation possible over the next 15 years. This is not surprising, as INDCs generally reflect what countries believe they can achieve on their own, “nationally determined”. Enhanced action by a variety of other stakeholders and through international cooperation can enable them to do more.

This does not mean that the emissions reduction potential from these cooperative initiatives would all be “additional” to the commitments in the INDCs (except in international aviation and shipping, where emissions are not included in national inventories). Rather, insofar as countries are not yet planning to pursue the actions recommended here, the analysis indicates the potential to raise national commitments in the future. Multi-stakeholder action and international cooperation can thus help governments achieve considerably more mitigation than they now see as feasible.

In this sense the Paris climate conference, building on the Financing for Development and Sustainable Development Goal conferences earlier in the year, creates a much broader opportunity to promote action for growth and climate. Nationally determined commitments will be the bedrock of the new international agreement. But as this report shows, national action can be supplemented, in Paris and beyond, by many forms of international and multi-stakeholder cooperation. In all the fields outlined in this report, governments, states and regions, cities, businesses, and international and civil society organisations have the opportunity to bring forward new commitments to driving low-carbon and climate-resilient growth. These have the potential to enable countries to reduce emissions much further than they can on their own. They can bring the world as a whole much closer to the 2°C pathway. And they can bring all countries the benefits of stronger economic performance, development and poverty reduction.

We live in an urban era. Cities are growing at an unprecedented rate, particularly in the developing world, with 1.4 million people added to urban areas each week. By 2030, around 60% of the global population will live in cities. Cities are engines of economic growth and social change, expected to produce about 85% of global GDP in 2015 – and they generate 71–76% of energy-related global greenhouse gas (GHG) emissions. With their dense populations, concentrations of property and infrastructure, and large paved areas, cities are also particularly vulnerable to floods, storm surges and other climate impacts, particularly in coastal regions and along rivers.

All these factors make it crucial to ensure that the infrastructure investments made in cities in the next several years are both low-carbon and climate-resilient. As shown in Better Growth, Better Climate, cities have much to gain from adopting more compact, connected and efficient forms of development: greater economic productivity and appeal to investors, improved air quality and public health, reduced poverty and enhanced safety, and substantial avoided infrastructure and public service costs. For urban leaders, low-carbon strategies are thus as much about building healthier, more liveable and more productive cities as about reducing GHG emissions.

We live in an urban era. Cities are growing at an unprecedented rate, particularly in the developing world, with 1.4 million people added to urban areas each week. By 2030, around 60% of the global population will live in cities.91 Cities are engines of economic growth and social change, expected to produce about 85% of global GDP in 201592– and they generate 71–76% of energy-related global greenhouse gas (GHG) emissions.93 With their dense populations, concentrations of property and infrastructure, and large paved areas, cities are also particularly vulnerable to floods, storm surges and other climate impacts, particularly in coastal regions and along rivers.

All these factors make it crucial to ensure that the infrastructure investments made in cities in the next several years are both low-carbon and climate-resilient. As shown in Better Growth, Better Climate, cities have much to gain from adopting more compact, connected and efficient forms of development: greater economic productivity and appeal to investors, improved air quality and public health, reduced poverty and enhanced safety, and substantial avoided infrastructure and public service costs. For urban leaders, low-carbon strategies are thus as much about building healthier, more liveable and more productive cities as about reducing GHG emissions.

Mayors and local authorities increasingly recognise the economic and other benefits of climate action, and many are not only demonstrating leadership by taking action in their own cities, but engaging their peers and working to raise ambition through groups such as the C40 Cities Climate Leadership Group, Local Governments for Sustainability (ICLEI) and United Cities and Local Governments (UCLG). Members of these networks have already agreed to commitments equivalent to 0.4 Gt CO2 in annual emission reductions by 2030.94 And momentum is growing.

At the UN Climate Summit in 2014, urban leaders formed a new “Compact of Mayors” committed to tracking and reducing GHG emissions under a common accountability framework, while also making their cities more resilient.95 As of June 2015, 80 cities have signed on, and many more are expected to join. The Compact builds on existing initiatives, such as the Covenant of Mayors in Europe, whose more than 6,000 signatories have set emission reduction targets and adopted sustainable energy action plans to help meet them.

But action needs to be scaled up and accelerated. Many cities, particularly in developing countries, need support from national and international institutions to transition to low-carbon development models. National policy is critical, generally determining the powers and financial resources available to city authorities. Regional and provincial governments can also play crucial roles – particularly as many are leading low-carbon action themselves, including through their own international Compact of States and Regions formed in 2014.96 At all levels, policy and finance environments need to shift quickly and significantly to help cities, states and regions change course.

New analysis undertaken for this report shows that low-carbon urban actions represent a US$16.6 trillion global economic opportunity.97 This analysis builds on a 2014 study for the UN Special Envoy for Cities and Climate Change and C40, which found that 11 key low-carbon measures in the buildings, transport and waste sectors, where cities have the greatest power to take action, could generate annual savings of 3.7 Gt CO2e in 2030 and 8.0 Gt CO2e in 2050.98

The largest 500 cities by population could contribute annual savings of 1.65 Gt CO2e by 2030, nearly half the identified urban mitigation potential.99

To evaluate the economic case for large-scale deployment of these measures, the New Climate Economy assessed the incremental costs that cities would face if they implemented them instead of their higher-carbon equivalents. The costs were then compared with the savings these measures would generate up to 2050 through reduced energy demand, relative to business as usual.100

The analysis was deliberately conservative, excluding savings that would accrue beyond 2050 and presenting only direct cost savings, not wider social, economic and environmental benefits.